How bad are Washington state taxes? The worst in the country, apparently

Washington State's tax system is widening the gap between the rich and the poor. That's according to the Institute on Taxation and Economic Policy (ITEP) based in Washington, D.C.

It says Washington state is number one on its "terrible ten" list of states whose tax systems make the poor poorer.

The sales tax and the lack of an income tax are big reasons why.

Washington once again beat Texas, which also has no income tax, because Texas leans a little less on sales taxes than Washington does. And sales taxes are particularly hard on lower-income families.

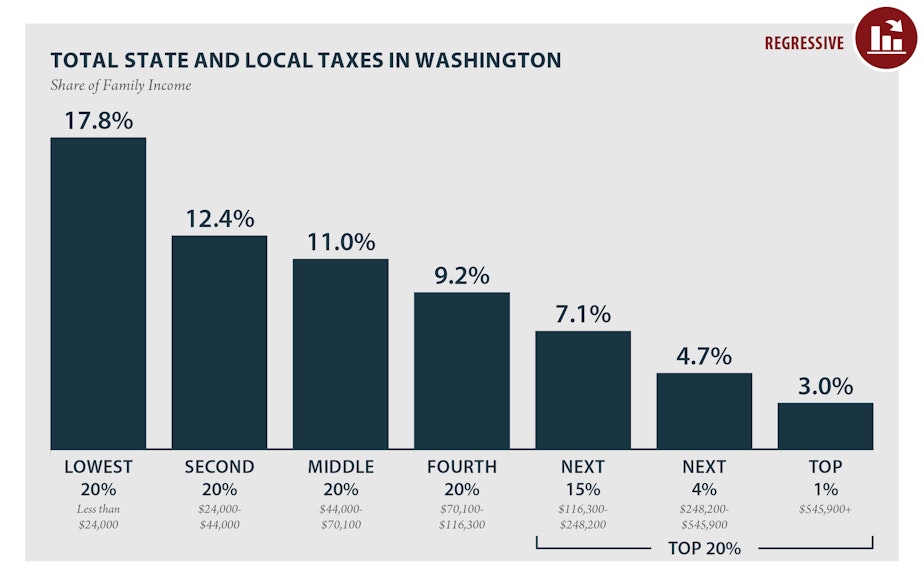

The institute found the poorest in Washington state lose 18 percent of their incomes to local governments, while the richest lose just 3 percent.

Even people with middle incomes have it relatively rough: 11 percent of their earnings go to local governments.

"The state's tax system is driving already stark income inequality,” said Carl Davis, the institute’s research director. “Driving it to an even worse place and widening the divide between the haves and the have-nots."

Sponsored

Washington's system looks equal but isn't

Davis said tax systems that run on sales and property taxes look like they treat everyone equally because the same rules apply to everyone: The sales tax is the same for everyone. Property taxes, which also get buried in rent, are set at the same rate and applied to the different values of properties.

However a sales tax, for example, isn’t proportional. It eats up more of a poor person’s income than a wealthier person’s.

“What you see is that Washington’s tax system couldn’t possibly be further from hitting people evenly,” Davis said. “People are having to devote very different shares of their household budgets to funding state and local government.”

Sponsored

Different values in Washington state

Washington state runs on a different set of tax values, set back in the Great Depression.

In an email to KUOW, the state’s Department of Revenue said Washington values uniformity in taxes. There's no graduated income tax, where the rich would pay proportionally more.

And there's no property tax credit for people with low incomes. The state identifies groups it wants to help stay in their homes, such as retired people. However it can't do as other states do and credit low income households for property taxes paid that they can't afford.

During the recession, Washington state did pass an earned income tax credit, which would have partially compensated the poor for their sales tax burden. However, the state never found the money to operate the program.

Sponsored

A slipping middle

Income inequality has been growing in the state since the end of the recession. Tech salaries have been going higher and other people’s earnings have been stagnating or growing at slower rates.

ITEP’s report indicates that Washingtonians making middle-income wages may have slipped.

When ITEP last looked at the state in 2015, $70,000 was an upper-middle class wage. Now, that’s in the middle 20 percent of earners.

And $40,000 was just barely middle class in 2015. Now it’s lower-middle – one notch up from the lowest 20 percent of earners in the state.

Sponsored

Incomes at the higher ends of the scale grew by leaps and bounds in that same period, according to ITEP.

As people in the Seattle region have learned, those higher wages coupled with housing shortages and fast-growth problems are bringing higher living costs and taxes for all.

“The wealthiest people and corporations have benefited most from our state’s booming economy,” said Andy Nicholas, associate director of Washington's Budget & Policy Center. “Meanwhile, hardworking people with lower and middle incomes are having a hard time keeping up with our state’s skyrocketing cost of living."

This story was produced in partnership with the Ravitch Fiscal Reporting Program at the Newmark Graduate School of Journalism at the City University of New York.