Those $1,200 Emergency Payments Are Arriving — And Debt Collectors May Be Eyeing Them

Those $1,200 federal payments to help Americans through the coronavirus crisis have started arriving in some people's bank accounts via direct deposit. But many people will have to wait longer — and there could be pitfalls, such as debt collectors grabbing the money before you do.

Those who'll be getting checks in the mail may not see them for weeks or even months. To get the money faster, millions of people will have to get direct deposit account information to the IRS.

The IRS is just starting to bring "portals" online to let you do that. The first went live on Friday, but it's just for people who are not required to file taxes. Another tool expected this week will allow everybody else to provide the IRS account information for direct deposit if the IRS doesn't already have it.

Lauren Saunders, with the nonprofit National Consumer Law Center, is hoping the system will soon have multiple options to receive the money. "Hopefully they can set up direct deposit to a traditional bank account or to a prepaid account," she says. So the government could load the money onto a type of debit card that doesn't require you to have a bank account.

Millions of lower income Americans don't have traditional bank accounts. And Saunders and other consumer advocates are worried that the people who need the money the most might not be able to get it quickly.

Sponsored

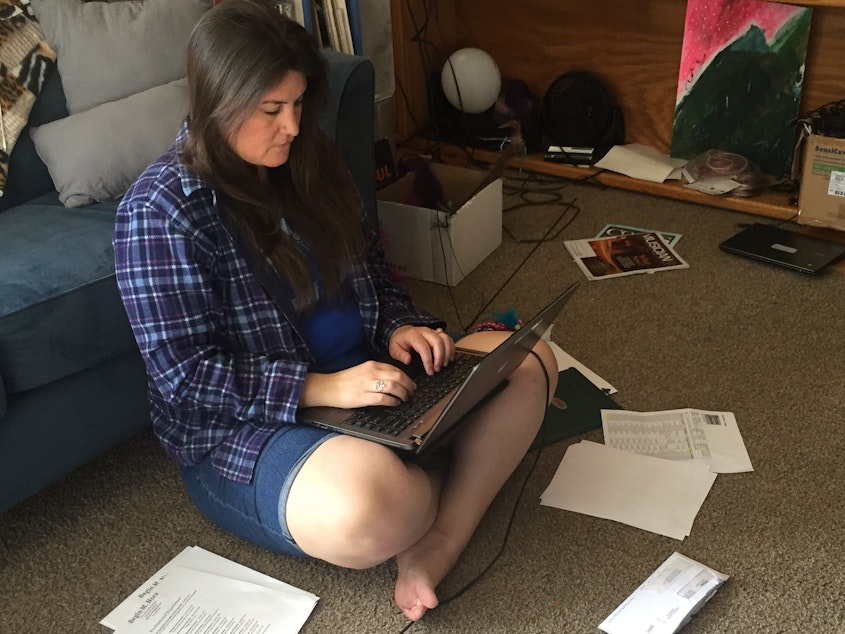

Begin Nora lives in Seattle, where the pandemic first hit in the U.S. She's a violinist, and events were pretty quickly called off.

"I have lost all of my income," Nora says. She usually cobbles together a living by performing and teaching music in schools and elsewhere. She has quite a few different gig jobs, "at least 12 different jobs, so it's a huge confusing conglomeration of things." So she's had trouble trying to figure out how to navigate the state's website to file for unemployment.

Her husband makes just above minimum wage at an auto collision repair shop. His hours have been cut back, and they have three teenage kids.

"It is very scary," Nora says. "Especially since we were already ... a family on a low income. We're relying on our local school food bank, and school drive-up grab-and-go meals."

So the couple is really looking forward to getting that emergency money from the government. Since they filed taxes electronically, the payment should come automatically and through direct deposit. "I am checking my bank account daily to see if it has arrived," Nora says.

Sponsored

But the couple has some debt. Nora's husband got a hernia and they've been struggling to pay off an unexpected medical bill for upwards of $5,000.

Of course, many people on low incomes have unpaid bills, which can bring on the debt collectors. And Saunders worries that millions of Americans could get their emergency government payments snatched right out of their bank accounts.

"It happens all the time to people," says Farah Majid, a lawyer at Legal Services Alabama. She notes that debt collectors often get court judgments against people, which enables the collectors to get the money from your bank.

If a debt collector can find money sitting in a bank account, she says, "they can just grab whatever money is in there, so it's really easy for them to collect their money that way." Some states have protections but many allow collectors to grab large sums of money, Majid says.

And she says when a big check comes in, like a tax refund, collectors can pounce. So she's concerned now that collectors might be gearing up to grab these emergency payments.

Sponsored

"That is what really scares me," she says. "People that need this money are depending on it desperately right now, which is why the government is giving it to them, could then turn around and lose it unexpectedly and not have any options."

But there is something the government could do to try to block the debt collectors. There's already a system to protect benefits such as Social Security. Those government payments are coded in a special way.

"Banks automatically know not to let collectors grab that money," says the NCLC's Saunders."We are trying to get these stimulus payments coded in the exact same way because they are intended for food and basic necessities, just like Social Security payments."

There's some bipartisan support for that. In the meantime, if you think debt collectors or payday lenders with access to your bank account might grab the money, advocates say you'll probably want to be vigilant about getting that money before they do. Or you could have the money sent to a different bank account, or a prepaid card if that becomes possible, the advocates say.

There's something else to watch for beyond debt collection. Unless you get Social Security, if you didn't file tax returns in the past two years you won't get a payment sent to you automatically. And, if you did file a return, but got a check sent to you in the mail, you will get the payment much more quickly signing up with the IRS for direct deposit.

Sponsored

The latest information on how to do that, along with how much money you should be expecting based on your income and whether you have children, is available at this IRS web page.

For people without a bank account who would like to open one, Saunders' nonprofit is telling people to go to joinbankon.org. That site has suggestions for ways to do that, even if you've had trouble with bank accounts in the past, so you can get your government payment more quickly. [Copyright 2020 NPR]