What to do when your retirement plan goes up in smoke during a global pandemic

Amy and Walt were just about to retire.

“We just made it through the 2008 crash and we were just coming out of it and starting to feel good," Amy said.

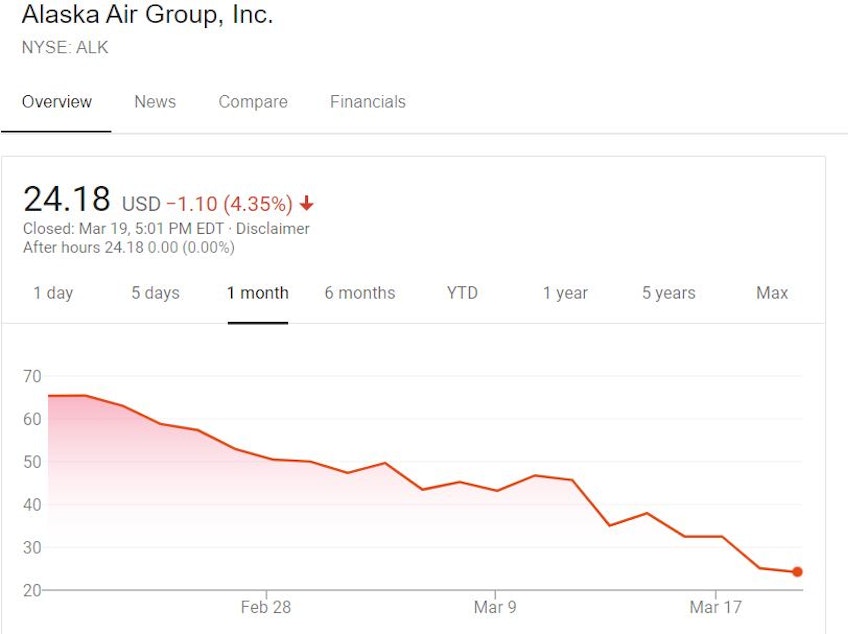

Then, the biggest point loss ever for the Dow Jones Industrial Average hit, and their retirement plan went up in smoke for the second time in just over a decade.

“We had pretty much enough money to retire in a couple years. Now I don’t think we’ll have enough to retire on, even if we come out of this in a year or two," Amy said.

So KUOW put Amy in a room with Charles Brighton, the co-founder of Brighton Jones, an independent financial advisory firm based in Seattle. And by "room" we mean a social distancing-approved video chat.

What do you do if you’re staring into a black hole that was once your 401(k) or other retirement plan?

Don't make any rash decisions, Brighton said, offering a metaphor suited to a wet, seafaring city like Seattle.

“You don’t try to wring your shirt out in the middle of a storm. It’s not going to dry. You just have to wait it out. And then make decisions after things calm down,” Brighton said.

Sponsored

Amy wanted to know: Just how bad is this crash? Could this get depression-era bad?

Brighton said that seems super unlikely.

“I’ve been in this business for 30 years. And I’ve been through a number of crashes, including the big one in 2008," he said.

But this one is different. This time around, supply and demand are both being hit hard. That makes it harder to solve, Brighton said.

Even when the government lowers interest rates, and businesses cut prices, for example, the demand just isn’t there for things like cruise ships or airline tickets. The government just doesn't have many tools to deal with it.

Sponsored

Given their fears about this downturn, Amy and Walt sold stock earlier in the week to try and stop the bleeding.

“We wanted some cash on hand in case, to avoid the worst case scenario,” Amy said.

That created a new question: What to do with the cash? Amy asked if she should "keep it in savings" or "pay down debt" from their home equity line of credit.

Brighton said having cash right now is “not a bad thing,” and that he typically recommends paying down debt if you’ve got it. As a general rule, “Pay down the highest rates first,” he said.

Amy and Walt have another big money problem on top of retirement. Their daughter, age 16, will start college in two years.

Sponsored

“We have 10,000 saved. What do you suggest we do besides scholarships?” Amy asked.

“The problem with college coming up so quickly for your daughter is, you don’t have a very long time ... to go invest in the stock market, or things that are more aggressive that offer a better return over time,” Brighton said.

Brighton said there are two good options for folks who need to pay for college soon: Shop around for cheaper tuition, and consider taking out student loans.